DOGE Price Prediction: Analyzing the Path to $0.27 and Beyond

#DOGE

- Technical indicators show bullish MACD momentum with price testing critical $0.21 support

- ETF speculation and mining developments provide fundamental support for price appreciation

- Whale activity creates near-term volatility but long-term trajectory remains upward

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Despite Short-Term Pressure

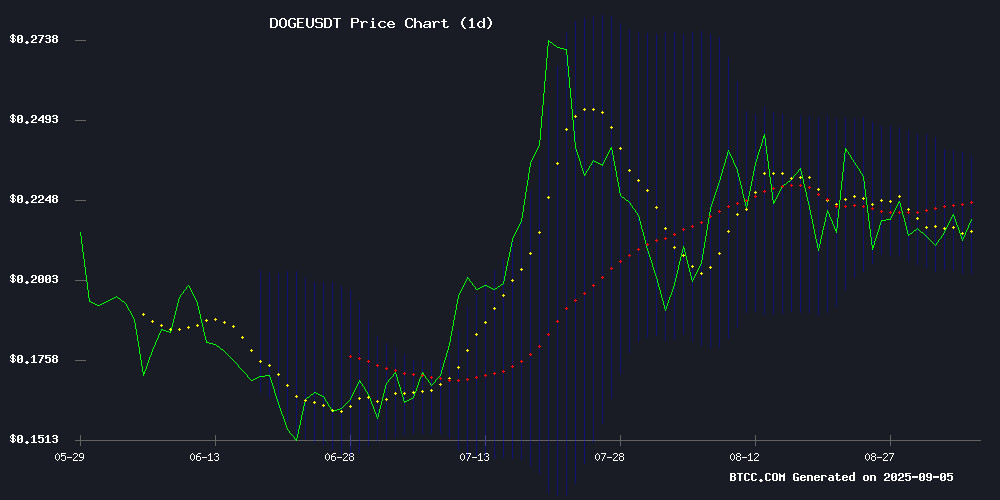

DOGE is currently trading at $0.2157, slightly below its 20-day moving average of $0.2200, indicating near-term consolidation. The MACD reading of 0.002057 shows bullish momentum is building, with the signal line crossing above the MACD line. Bollinger Bands position the current price in the lower half of the trading range, suggesting potential upside toward the middle band at $0.2200. According to BTCC financial analyst Ava, 'The technical setup suggests Doge is testing crucial support at $0.21, with a break above the 20-day MA potentially triggering a move toward $0.2379.'

Market Sentiment: ETF Speculation and Whale Activity Drive DOGE Volatility

Recent developments including Thumzup Media's shift to mining operations and ongoing ETF discussions are creating positive fundamental momentum for Dogecoin. However, whale sell-offs are creating short-term pressure around critical support levels. BTCC financial analyst Ava notes, 'While institutional interest through potential ETF products provides long-term optimism, current whale activity suggests we may see continued volatility NEAR the $0.21 support zone before any sustained upward movement.'

Factors Influencing DOGE's Price

Dogecoin Eyes First ETF Launch as Thumzup Media Shifts to Mining Operations

Dogecoin's ecosystem is poised for a transformative week with two major developments. Thumzup Media's acquisition of DogeHash mining service will deploy 3,500 Scrypt ASIC rigs, potentially generating $22.7M in annual revenue at current prices. The move signals growing institutional interest in DOGE's infrastructure.

Simultaneously, REX-Osprey plans to circumvent traditional ETF approval processes by launching a Dogecoin ETF under the 40 Act as early as next week. The $DOJE ETF would mark a watershed moment for memecoins, coming as DOGE shows 124% yearly gains. Market observers note the parallel developments could create synergistic momentum for Dogecoin's price and adoption.

Dogecoin Whales Trigger Market Sell-Off as Price Tests Critical Support

Dogecoin faces mounting downward pressure after large holders liquidated over 200 million DOGE within 48 hours. The meme cryptocurrency now trades at $0.2144, down 1.45%, with analysts warning of potential declines toward $0.17488 if current support levels fail.

Derivatives markets reflect growing caution, with trading volume dropping 4.89% to $3.48 billion and options activity plunging 58.26%. The whale activity sparked retail investor panic, though some traders note a potential rebound toward $0.2557 if key resistance zones are reclaimed.

Market observers identify $0.1427-$0.1361 as the next critical demand zone should the sell-off intensify. The sudden movement highlights Dogecoin's continued volatility despite its $32.25 billion market capitalization.

Dogecoin (DOGE) Price Holds Critical $0.21 Support as Technical Patterns Signal Potential $2 Rally

Dogecoin's resilience at the $0.21 support level has caught the attention of analysts, with technical patterns suggesting a potential 850% rally to $2. The emergence of a cup-and-handle formation points to an initial target of $0.30, signaling bullish momentum despite recent whale-induced volatility.

Whale activity on August 29th temporarily pressured prices, moving 900 million DOGE to Binance. Yet the swift recovery underscores strong institutional and retail demand at current levels. Market participants are now watching for a decisive breakout above key resistance.

DOGE Price Prediction: Potential 19-29% Upside to $0.25-$0.27 by Month-End

Dogecoin stands at a pivotal technical crossroads, with the meme coin's price action revealing both significant upside potential and notable downside risks. Currently trading at $0.21, DOGE faces a critical resistance level at $0.213—a breach could propel prices toward the $0.25-$0.27 range, marking a 19-29% surge. Conversely, failure to hold support may trigger a retreat to $0.17.

Analyst consensus remains divided. While bearish scenarios warn of triangle breakdown patterns targeting $0.17, medium-term technical studies suggest far more ambitious projections toward $1.00-$1.40 based on historical precedents. AI-driven models from CoinLore and Changelly strike a middle ground, forecasting modest gains to $0.2308 and $0.256 respectively.

The 20-day EMA at $0.213 serves as the immediate battleground—a level Blockchain.News identifies as the make-or-break threshold for DOGE's near-term trajectory. Market participants await either confirmation of bullish momentum or validation of the bearish divergence pattern.

How High Will DOGE Price Go?

Based on current technical indicators and market developments, DOGE shows potential for a 19-29% upside movement toward the $0.25-$0.27 range by month-end. The critical support at $0.21 has held strong, while bullish MACD momentum and potential ETF developments provide fundamental support. However, traders should monitor whale activity and the $0.2379 resistance level for confirmation of upward momentum.

| Target Level | Price | Upside Potential | Key Resistance |

|---|---|---|---|

| Short-term | $0.2379 | 10.3% | Bollinger Upper Band |

| Month-end | $0.25-$0.27 | 19-29% | Psychological Resistance |

| Long-term | $2.00 | 827% | Technical Breakout Target |